London homebuyers’ average deposit is nearly three times greater (170%) than buyers across the rest of the country

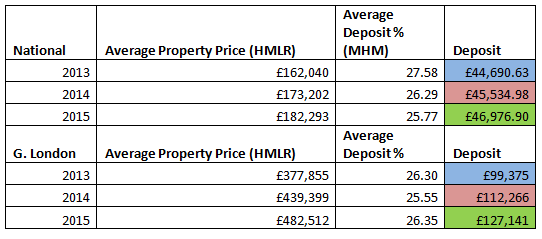

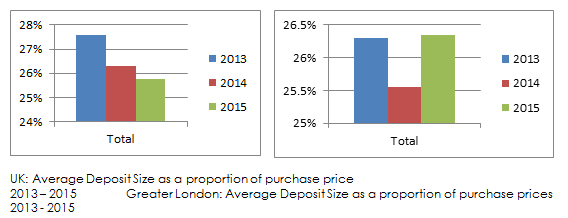

April 18, 2016The average deposit paid for a Greater London property is nearly three times larger than a home outside the capital, despite deposit sizes as a proportion of purchase prices falling nationally by 1.81% from 27.58% to 25.77%, according to research by My Home Move, the UK’s leading provider of mover conveyancing services.

The huge rise in house prices across the UK and in particular Greater London, has resulted in property buyers securing their home move with a deposit of £127,000 in the capital -nearly £30,000 more than they did in 2013 (£99,375).

Commenting on these findings, Doug Crawford, CEO of My Home Move said,

“The London property market has always commanded greater prices than anywhere else in the UK; but our research has shown just how extreme the situation is becoming. London property prices have risen by 27% in the last three years and while the rest of the UK has seen a small decrease in the average deposit size, those looking for a London home are depositing 170% more than their UK counterparts.

“This situation is unsustainable and has been driven by rising house prices. For some, their deposit will come from the equity in the property they are selling. However, for many, they will still need to save tens of thousands of pounds to make the move onto and up the property ladder.

“Ultimately, it still begs the question – who is going to help those looking to enter the capital’s housing market and those on the lower rungs of the ladder, first-time buyers and second-steppers? Earlier this year we predicted that 100,000 properties would be purchased in 2016 using gifted deposits courtesy of the Bank of Mum and Dad; and based on these figures, it looks like a very large portion of these could be based in the Greater London area.”

Having analysed over 60,000 purchase records to determine the average deposit size paid by home buyers between 2013 and 2015, My Home Move compared these findings to the average property prices held by HMLR (Land Registry) for the same period.